Investor Relations Operational and Other Risks

(1) Risk management system

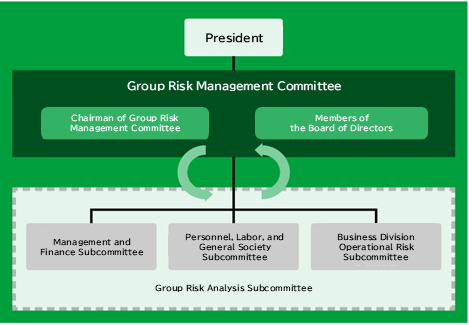

The ID Group is committed to obtaining an accurate grasp of the various risks that can have important effects on investors’ judgements and reducing risks that may have an impact on its management. For this purpose, the Group established the Group Risk Management Committee as an advisory body to the Board of Directors. The Committee divided the main risks it anticipates for the ID Group into three categories—management and financial risk; personnel, labor and general social risk; and business-segment risk—and established the Group Risk Analysis Subcommittee. The subcommittee identifies specific risks and proposes measures to deal with them, and the Group Risk Management Committee deliberates on and examines those proposals.

<Risk management system chart>

(2) Risk management methods

The ID Group uncovers risks and proposes measures to mitigate them with focus on the following elements.

- ① Using generative AI, we extract risk phenomena confronting the Group and draft risk scenarios in reference to them (details of manifested risk phenomena).

- ② Based on those risk scenarios, we measure and evaluate the impact those risks may have on the Group.

- ③ For risks that are deemed important as a result of our evaluations, we draft risk management measures and plans.

- ④ Results of those risk management measures and plans are confirmed and evaluated and the PDCA cycle is implemented.

(3) Serious risks

The following is a list of matters related to the ID Group’s business results and accounts that could have serious impact on investors’ assessments of the Group. Future-oriented statements in the discussion below constitute the judgement of the ID Group as of March 31, 2025.

1. Changes in the market environment

Demand is solid for process streamlining to address the social issue of personnel shortages and IT investment related to digital transformation (DX). With the advance of cloud services and generative AI, construction of data centers is expected to accelerate in Japan. Security risks are also growing, amid threats such as the increasing sophistication of cyberattacks.

Amid these trends, the ID Group’s business results and financial position could be affected by the loss of order opportunities as a result of delays in response to high value-added fields using cutting-edge technology, a decline in competitiveness against our competitors, or decline in clients’ willingness to invest in IT due to significant changes in social and economic conditions.

With these conditions as the backdrop, on April 1, 2025 the ID Group merged its operating companies. The purpose was to provide services as a unified Group entity and create synergies, enabling flexible response to changes in the market environment.

The Group has formulated a new Mid-term Management Plan, Next 50 Episode Ⅲ “JUMP!!!,” covering a three-year period beginning in the fiscal year ending March 31, 2026. In an industry changing as a result of accelerating personnel shortages and technological advancement, the ID Group aims to raise the value of the people who run its businesses to new and higher levels, transforming the Group’s business model into one of high profitability and growth.

2. Corporate acquisition

One of the Group’s strategies for expanding operations is to do so through mergers and acquisitions. However, changes in the market environment and unexpected events may prevent the Group from implementing these moves or result in effects other than originally anticipated. In such cases, the business results and financial condition of the ID Group may be impacted, for example by the need to appropriate impairment of goodwill or a loss on valuation of shares in affiliated companies.When implementing mergers and acquisitions, the Group strives to prevent these risks through due diligence by specialists such as accountants and lawyers, who examine the financial and tax status of target companies, related legal matters and other aspects. After the merger or acquisition is completed, the Group regularly monitors the management of the acquired company by attending meetings of the Board of Directors, inspecting its accounts and other measures. In these ways the Group strives to obtain a clear understanding of the impact of the merger or acquisition on the business results and financial condition of the ID Group.

3. Global business

Led by the Global Management Department, the ID Group maintains an appropriate understanding of business conditions at each overseas location and changes in the external environment. On individual risk events, the Group Risk Management Committee examines the details, confirms conditions, confirms progress on countermeasures and examines the effects of countermeasures. In these ways the Group makes every effort to reduce risks.

As of March 31, 2023, the Group has terminated operations in Myanmar due to lingering political instability in that country. The impact of this decision on Group business results is negligible.

4. Securing personnel

The Group strives to recruit and retain high-value-added personnel, both in Japan and overseas, including both fresh graduates and mid-career hires. After hiring, recruits undergo continuous training in technical and interpersonal skills. To respond to changing client needs, the Group invests actively in human capital to enhance skill sets. We provide “career enlightenment,” foster a corporate culture of self-starting, goal-oriented teams, and support health management. In these ways the ID Group focuses on employee engagement, boosting customer satisfaction and productivity in a virtuous cycle that continuously improves corporate value.

5. Information management

The Group has taken a number of steps to ensure data security. The Group has established a management framework to respond and confer across sectors on information management generally, spearheaded by an information management supervisor. Led by the Computer Incident Response Team (CSIRT), a dedicated cybersecurity team, the Group is strengthening various security measures and taking steps for effective response when incidents occur.

Finally, the Group is taking steps to improve employees’ compliance mindset. Employees are provided regular training on cybersecurity measures and education on revisions to Group regulations in response to laws and ordinances. Moreover, the Group has obtained certification under PrivacyMark and ISO27001 and is committed to maintaining and supporting those certifications.

6. Sustainability

(a)Climate change

In recent years, climate change has made natural disasters such as earthquakes, torrential rains and large typhoons more severe and frequent. Society expects companies to provide measures to grapple with this problem, such as measures to reduce greenhouse-gas emissions and introduce sustainable energy, thereby contributing to the achievement of a carbon-free society.

If measures to counteract climate change are inadequate, corporate clients and other stakeholders could lower their estimation of the ID Group, causing loss of business opportunities and other adverse impacts on the business results and financial condition of the Group. For these reasons, the Group advances eco-friendly business activities, endorsing the Task Force on Climate-related Financial Disclosures (TCFD) and acquiring certification under ISO 14001. These initiatives are disclosed on the Group’s website.

(b)Human rights

In recent years, increasingly urgent voices have been calling for measures to safeguard human rights, including strengthening of international standards on human rights.

The ID Group takes these risks seriously. The Group has established the ID Group Human Rights Policy, supporting international norms respecting human rights. The Group clearly demonstrates conduct to which employees should refer in the course of their business activities and strives to foster a corporate culture of compliance with norms of human rights. Moreover, the Group provides training and other services to its business partners, encouraging them to familiarize themselves with and uphold the ID Group Human Rights Policy. Through these initiatives, the Group strives to conduct business with due respect for human rights.

7. Natural disasters, conflict, terrorism and pandemic-level infectious diseases

Such irregular events can obstruct the execution of Group operations. To minimize their impact, the Group has prepared a Crisis Management Manual and Business Continuity Plan (BCP). The Group has also taken a range of other preventive actions. Some head-office functions have been shifted to Sanin Business Process Outsourcing Center, mitigating risk from centralization, and the Group continues to advance diversification of work styles, including promotion of remote work. The Group will continue to strive to ensure business continuity, by accumulating stores of food and medical goods, revising manuals and conducting regular drills on the use of safety confirmation systems.

8. Software development and IT infrastructure projects

To hedge these risks, the ID Group is introducing quality management systems that conform to ISO9001. When an inquiry for a new, large project is received, an order-acceptance review meeting is convened to examine the project based on management judgements of business policy, profitability, staffing, technical competence and opportunities to build technical knowledge. Also, the Quality Management Division analyzes and manages risk across all processes, from the project-proposal and estimate stages to delivery, conducting regular reviews of quality, cost and delivery (QCD) as the project unfolds. In this way abnormalities can be detected at an early stage to prevent the occurrence of unprofitable projects.

The Group also expects increasingly to engage in cross-disciplinary projects that straddle multiple services, as well as large-scale, bundled-contract-type projects. To manage such projects in a timely and accurate manner, the ID Group is revising its in-house project management procedures and overhauling management accounting and other in-house systems.

9. System management projects

The ID Group is making a number of moves to prevent such system failures. For example, the Group thoroughly implements a system for double-checking of high-impact projects and uses a suite of tools to enhance automation. The Quality Management Division plans and executes a variety of measures, including training to prevent failures, analyzing and giving feedback on the causes of failures, and on-site inspections. Moreover, the Group has obtained certification under ISO9001 and is continuously improving quality. As of this writing, no major system failures have occurred.

DX is advancing in the field of system management, which is the Group’s core business. As DX progresses, companies are slashing maintenance costs in existing systems, advancing automation and moving to use of the public cloud, while major customers of the ID Group are shifting to next-generation systems and centralizing operations. Given the enormity of the transformation now under way, if the Group were to confine itself to simple, conventional operations, it would risk a major downsizing of its business.

The Group is vigorously advancing next-generation operation services. To ensure bright prospects for its system management operations, the Group is automating operations to increase value-added and improving efficiency through support for remote operation. The Group is also applying ID-VROP, a virtual system operation center developed by the Group, to the operation of multiple sites.

10. Recruiting from partner companies

To minimize this risk, the Group shares information closely with partner companies. On a regular basis, the Group conducts partner meetings and seminars, sharing information about business policies, individual projects and case studies of trouble encountered. With its core partners, the Group is further strengthening cooperative relationships, forming cooperative frameworks to improve its ability to win batch project orders and enhance quality management. In these ways, the Group is working to improve quality as well as its ability to assign capable people.

Advanced areas of IT, such as IT infrastructure and cybersecurity, are expected to enjoy growing demand. The ID Group works hard to secure a sophisticated engineering workforce. The Group discloses information on its initiatives and personnel training policies in these fields. In tandem with training of its own employees, the ID Group supports partner companies in their efforts to cultivate technical personnel.