Investor Relations Dividends

Basic Policy on Distribution of Earnings and Current-term Dividends

ID Holdings Corporation considers the return of profits to shareholders to be one of chief management priorities. The Company is making every effort to secure a strong business foundation and improve revenue stability and return on equity. Accordingly, the Company’s basic policy is to maintain appropriate distributions of profits based on business results.

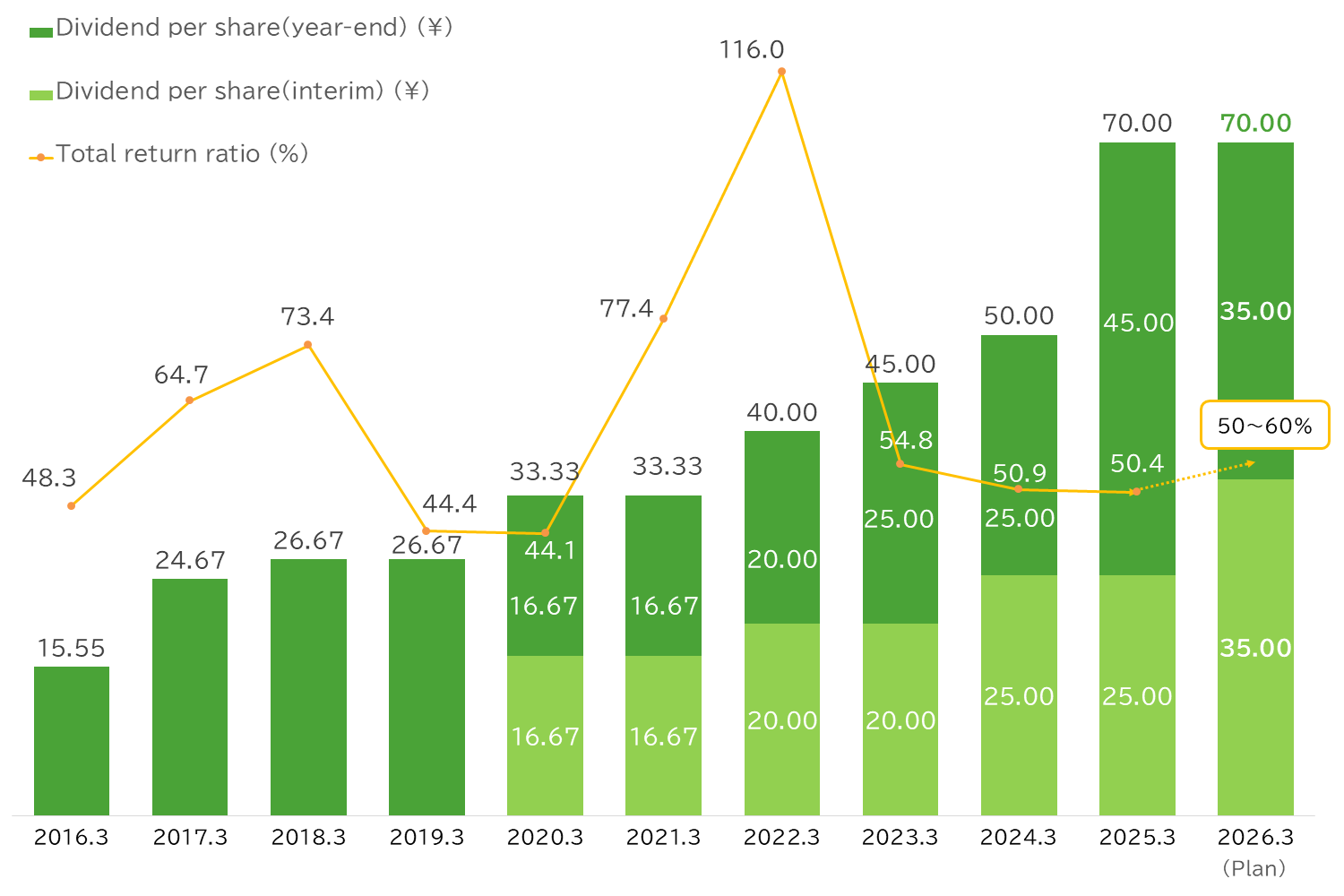

Also, the Company is targeting total return ratio, which includes both dividends and purchase of treasury shares, of 50–60%.

Regarding the interim dividend for FY2025, it was resolved at the Board of Directors meeting held on October 31, 2025, to set it at 35 yen per share. The year-end dividend is scheduled as 35 yen per share as well.

Dividend per Share and Total Return Ratio

*The Company conducted a 1.5-for-1 stock split of common stock with an effective date of July 1, 2021. Dividend per share before 2021.3,

the recorded values are adjusted to reflect stock split above.